Consumer Price Index (CPI)

The definition of the term Consumer Price Index or CPI is the measurement of the rate of inflation or deflation according to a weighted market basket of goods and services that includes such items as transportation costs, health care costs, housing costs, and food costs. These statistics are released monthly by the United States Bureau of Labor Statistics.

In other words, we could look at the CPI as an average of the prices of goods and services commonly bought by families in urban areas. This indexes the most well-known inflation gauge and is often referred to as the cost-of-living index, to which labor contracts, rents, and social security are tied to.

What is the Consumer Price Index Used For?

The CPI measures the cost of buying a fixed bundle of goods that are representative of the purchase of the typical working-class, urban family. It is also known as an economic indicator. While inflation is a decline in the purchasing power of the money, a climb in prices, deflation is the increase of purchasing power and decrease of prices. Both of these can negatively impact a healthy economy. With the help of the CPI, citizens, businesses and the government can get an idea of price changes throughout the economy that will give them the tools to make informed economic decisions. This index is also used to verify people’s eligibility for government assistance programs and provides cost-of-living wage adjustments for US employees.

The index excluding volatile energy and food costs is often called the core rate of inflation. The base year for the CPI index was 1982-84 at which time it was assigned 100. So, if the CPI is at 100 that means that it reverted back to the inflation levels of 1984. These statistics allow economists to understand changes in the economy when compared to any other period in the past. The CPI is important to landlords because it helps keep the base monthly rent in pace with inflation. The monthly rent will increase in a percentage equal to the increase of the CPI figure.

Calculating the Consumer Price Index

The Bureau of Labor Statistics (BLS) of the U.S. Department of Labor publishes the CPI figures around the 18th of each month. They reach the CPI figure by looking at the cost of a basket of goods and services during a specific month and dividing it to the cost of the same basket the month before. In order to do this the BLS records around 80,000 items monthly through information from various service providers across the country. Once the calculation is complete, the best outlook for the CPI is determined.

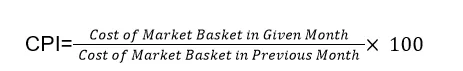

The consumer price index for one item is determined through the following formula:

This formula makes it possible for the BLS to know how much prices changed since when the index was first determined in 1982. If we look at the consumer price index calculated for March of 2022 at 264.8, we can say that since 1982, there has been a 164.8% increase in prices. However, when it comes to the percentages that really matter for today’s economy, we look at a 1.2% increase between February and March and an 8.2% increase over the last 12 months.

Economists also use other calculations to establish the state of the economy. The Gross Domestic Products (GDP) for example, determines the value of the products and services of one country during a given year.

Popular Real Estate Terms

Property deed in which the grantor limits the title warranty to the grantee. A grantor does not warrant a title defect to the property occurring from a happening before the time of his ...

The substitution of one person or business for another when the substituted person or business has the same rights and obligations as the original party. An insurance company can surogate ...

Home inspector is the name the real estate industry calls the professional responsible for the close and thorough examination of a property. The home inspector usually is called upon ...

Way to determine the capitalization rate of income property for valuation purposes by weighting the rate of interest and source of financing in percentage terms. ...

Sudden, drastic change in organization, direction, objectives, strategies, or functioning. It is often associated with a new owner who wants things his way. Managers and employees may ...

Also called an installment sales contract or contract foe feed. A type of creative financing in real estate allowing the seller to finance a buyer by allowing him or her to make a down ...

Method of revenue recognition based on delivery instead of sale. ...

Broadly speaking, a commission is a remuneration a person receives after acting on someone else’s behalf.In the real estate world, you’ll usually hear the term “sales ...

(1) Return of the principal invested in real estate. It excludes income earned. (2) Collection of a previously written off bad debt. ...

Comments for Consumer Price Index (CPI)

Should commission schedules be adjusted as CPI changes?

Jan 09, 2019 17:30:29According to the U.S. Department of Labor CPI released in November 2018, the all items index increased 2.2 percent for the 12 months ending November. Now it is up to every real estate broker to decide if they want to change their commission schedule based on this. The average inflation of the United States in 2018 was 2.49 %. A slight increase in your commission schedule should not surprise anyone, especially in the first month of the year. But maybe you want to check on your competitor's approach, too.

Jan 10, 2019 04:14:47Have a question or comment?

We're here to help.