Annuity Factor

The annuity factor definition is the use of a financial method that shows the value, present or future, of an amount when it is multiplied by a periodic amount. The calculation of an annuity factor requires the number of years involved, or the periodic amount, and the percentage rate applicable. The most often used for annuity factors are investments with either or both an annual payment or return. Typical examples of annuity factors being applied are savings accounts, certain types of insurances, or retirement savings plans.

The annuity factor meaning is a particular type of accumulating discount factor used to determine the present or future value of annuities, as well as equated installments. Another name for annuity factors is the annuity formula, and we’ll get into that momentarily.

The Present Value Annuity Factor

The present value annuity factor allows you to determine the amount of money required at the present time in order to result in a future series of payments assuming a fixed interest rate is applied.

In order to reach the present value annuity factor, a formula is used that discounts a future value amount to the present value amount through the use of the applicable interest rate. The period of time during which the investment will last is also taken into account to reach the correct value.

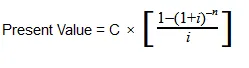

The Present Value Annuity Formula

With:

C=cash flow per period

i = interest rate

n = number of payments

The Future Value Annuity Factor

The future value annuity factor gives access to the final return value of a series of regular investments taking into account their worth at a future time, usually at the end of the investing period, assuming that a fixed interest rate is applied.

To reach the future value annuity factor, the formula above is slightly altered in order to add the values collected over the years by also accounting for the set interest rate.

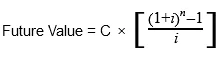

The Future Value Annuity Factor

With:

C=cash flow per period

i = interest rate

n = number of payments

Applying the Annuity Factor formulas:

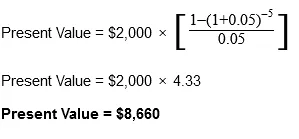

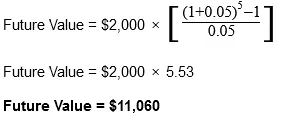

Considering an investment with an annual $2,000 payment over the course of five years at an interest rate of 5%, let’s see what the present and future value would be.

The previous formulas can help you determine the present and future values of ordinary annuities. While the math might seem complicated, there are financial calculators online that can help you out with the correct inputs and data.

Popular Real Estate Terms

(1) Surrendering voluntarily or involuntarily ownership of property or an interest therein. (2) Court order to give up possession or the right to property such as in the case of an ...

The Exclusive Right to Sell Listing is a type of Listing where the Listing Broker/Agent wins his/her commission even if he/she wasn’t directly responsible for the sale.Let’s ...

Type of property distribution occurring when a person dies intestate. The estate id divided by the children of the deceased and by their children. For example, if a husband dies intestate, ...

Certificate of an officer stating that a sworn statement is genuine stating when, where and before whom the statement was sworn. A jurat commonly appears at the bottom of an affidavit. ...

Raising money by mortgages and borrowing the money directly from financial institutions. The presence of debt financing provides financial leverage, which tends to magnify the effects of ...

The term after-tax rate of return calculates an investor’s net return after income taxes. The calculation is used by many businesses and investors to determine their real earnings. ...

Null or void something; Revoke or destroy; rescind or set aside; abandon; abolish; repeal; surrender; waive; terminate. In real estate, to void a buy or sell order, price, or quantity. The ...

Home of 1 to 3 stories with stucco outside and a roof made of red tiles. ...

Those factors causing the movement of people, industry, and business from the central city to the outside central city areas, suburbs, and/or small cities. Elements of the dispersing force ...

Have a question or comment?

We're here to help.