Effective Interest Rate

The term effective interest rate is the actual return from a savings account or any investment where you pay interest when considering the effects of compounding costs over time. Through an effective interest rate, you can fully and correctly determine the real percentage rate that you own on a loan’s interest, a credit card, or any other debt type.

An effective interest rate is also referred to as an effective annual interest rate, the annual equivalent rate, or the effective rate.

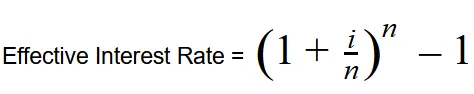

The Effective Interest Rate Formula:

With:

i = Nominal Interest Rate

n = Number of periods

What does the Effective Interest Rate Mean?

When you look at loans, the way through which they are advertised will give you two types of information. Firstly, we’ll have the nominal interest rate, which doesn’t consider the effects compounding interest or fees have on the financial product. Secondly, and the one we focus on now, the effective interest rate, which gives you the real return paid on savings of the actual cost of a loan because it does take into account the effect fees and compounding interest have on the financial product.

For that exact reason, knowing and understanding what the effective interest rate means is important. Through a proper understanding of the effective interest rate, you can compare offers more accurately to make an informed decision based on the result.

How to Find the Effective Interest Rate?

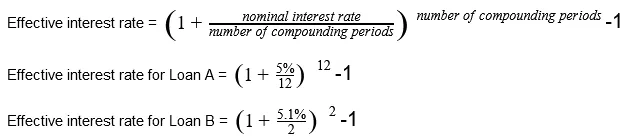

To adequately explain how to find the effective interest rate from any financial product’s promotional information, we will look at two examples. Firstly, we’ll have Loan A that has a 5% interest rate that’s compounded monthly. Secondly, we’ll have Loan B with a 5.1% interest rate that’s compounded bi-annually.

Both of these loans are advertised with their nominal interest rate. Remember, this is the one that doesn’t take into account the effects fees and compounding interest has on the loan. To calculate the effective interest rate, we’ll use the formula shown above.

While the nominal interest rate for Loan A is smaller than that of Loan B’s, the effective interest rate from Loan B is lower than that of Loan A’s. This occurs because Loan B has fewer compounding times over the course of a year.

Popular Real Estate Terms

Prepayment to a landlord for refurbishing the unit beyond what would be anticipated from customary wear and tear. It is like a damage deposit. The security deposit may be refunded at the ...

Property devoted to only one such as a medical building. ...

Tank placed beneath the ground to accumulate sewage. ...

Span of time a rental agreement is free to the occupant. A landlord may offer this as an incentive to stimulate rentals. For example, an owner of an office building may provide a free ...

The definition of obligor is a position that comes from obligation and indicates a party that has ‘promised’ to perform a specific act. In the financing world, an obligor is ...

(1) Judgment against a defendant who does not respond to the plaintiffs lawsuit or fails to appear in court at the hearing or trial date. (2) Judgment issued by the court against the ...

Mock closing; all information is available prior to an actual closing in order to insure all documents are properly executed by the appropriate parties. A preclosing is normally used only ...

(1) Judges remark in a court ruling not in and of itself embodying the law. A dictum merely illustrates or amplifies the ruling. (2) Arbitrator's ruling. ...

Same as term REIT: Type of investment company that invests money in mortgages and various types of investment in real estate, in order to earn profits for shareholders. Shareholders receive ...

Have a question or comment?

We're here to help.