Coefficient Of Dispersion

The coefficient of dispersion is how municipalities can determine differences between the assessed values of properties in an area or neighborhood. It gives a broader look at the state of the market, and a way to evaluate how consistent the appraisal of the properties is. The definition of the coefficient of dispersion that is used exclusively in dealing with market values and properties is a measure of how much values of a particular variable vary around the mean or median. The end value is represented in percentage from the median.

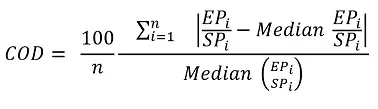

The Coefficient of Dispersion’s formula:

COD = coefficient of dispersion

N = number of properties in the sample

EPi = appraised value of ith property

SPi = sale value of ith property

∑ = summation of all the values in the group

How to Calculate the Coefficient of Dispersion?

After that insane formula, we understand if homeowners want to stay clear of it, but there are reasons why any homeowner would want to use it. If, for example, you’re house was appraised at a value that is higher than you expect, and the same happened to other neighbors, you can figure out if this is a trend in the area to increase taxes or just the increase of the market value in the area.

Example:

John investigated and managed to find the appraised value of 7 properties around him as well as the actual price for those properties.

|

Appraised Value |

Sales Price |

|

359,000 |

370,000 |

|

362,000 |

373,000 |

|

347,000 |

358,000 |

|

329,000 |

340,000 |

|

384,000 |

396,000 |

|

372,000 |

386,000 |

|

395,000 |

396,000 |

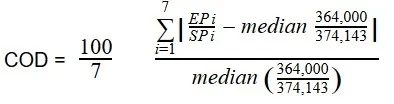

Now, John finds out the median appraised value by adding all the appraised values, then dividing it by seven properties ($362,000) and does the same to the median sale price ($373,000). With these values, he can start using the formula.

The median appraised value divided by the median sale value is 0.9729.

John returns to his table to discover the EPi/SPi for each property because the ∑ requires him to discover that value independently for each before he subtracts 0.9729 (the median EPi/SPi) from each:

|

Appraised Value |

Sales Price |

EPi/SPi |

|

359,000 |

370,000 |

0.9702 |

|

362,000 |

373,000 |

0.9705 |

|

347,000 |

358,000 |

0.9692 |

|

329,000 |

340,000 |

0.9676 |

|

384,000 |

396,000 |

0.9696 |

|

372,000 |

386,000 |

0.9637 |

|

395,000 |

396,000 |

0.9974 |

With that out of the way, John needs to subtract 0.9729 from each value. Here he considered negative values positive:

|

Appraised Value |

Sales Price |

EPi/SPi |

EPi/SPi-0.9729 |

|

359,000 |

370,000 |

0.9702 |

0.0027 |

|

362,000 |

373,000 |

0.9705 |

0.0024 |

|

347,000 |

358,000 |

0.9692 |

0.0037 |

|

329,000 |

340,000 |

0.9676 |

0.0053 |

|

384,000 |

396,000 |

0.9696 |

0.0033 |

|

372,000 |

386,000 |

0.9637 |

0.0092 |

|

395,000 |

396,000 |

0.9974 |

0.0245 |

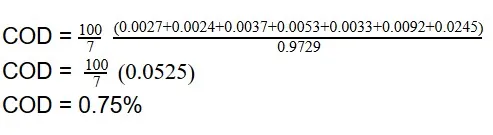

Now that he has all the data necessary, John can work the formula:

The coefficient of dispersion is a complex formula but the example above tells us that the average difference the houses have from the median of the assessed sales ratio is 0.75%.

Popular Real Estate Terms

Secondary demand created from a primary agent or facility. ...

The net operating income definition is the total profit generated by a business or real estate development after the necessary operating expenses are taken out. In order to determine the ...

Licensed real estate broker who has a listing of property for sale. ...

Monies paid to use property, such as the use of natural resource extractions. The royalty payment is typically based upon some percentage of the income or fee for substances generated from ...

We all know what income is or what gross income means, but what is adjusted gross income? When a company calculates its income to determine their taxable income, they take the gross income ...

Lease agreement having level payments during the contractual period. It does not have an escalation clause to allow for increased costs due to increases in inflation, taxes, or other ...

The definition of alienation clause is the transfer or sale of a particular property or asset that can be applied once the owner has no more financial obligations to said property or asset. ...

The definition of cost of living is the amount of money you need to have in order to sustain a certain lifestyle. The cost of living refers to the amount of money you spend on housing, ...

Used to support two properties; it is attached to both. ...

Comments for Coefficient Of Dispersion

COD example unclear

Jan 15, 2023 09:18:18Hello. Let us shed some light on this.

Someone wants to find out the appraised value of several properties around them. and the sale price is higher. Then they discover the median appraised value ($362,000). They add all the appraised values of all the properties and divide them by the number of properties. And later does the same with the median sale price ($373,000) The median appraised value divided by the median sale value is around 0.9. Then, they calculate that the average difference between houses and the median is 0.75.

Jan 20, 2023 09:22:24Have a question or comment?

We're here to help.