Mortgage Amortization

The term mortgage amortization is the steady switch occurring to each mortgage payment between how much interest is covered and how much principal each month. Simply put, mortgage amortization is the plan for repaying a mortgage. Because the debt diminishes with each payment, the interest diminishes, and because the interest decreases monthly, the principal coverage increases with each payment.

The Mortgage Amortization Definition

Amortization is the way through which mortgages are repaid. This feature can be applied to mortgages with an equal monthly payment and a fixed timeline. Mortgages, as well as other loans, can be amortized.

Let’s see this through a more practical explanation. The trademark of an amortized mortgage or amortized loan is the shift from paying mostly interest every month to mainly paying principal every month. The math goes like this: for a $100,000 mortgage with a 4.5% interest rate, amortized over a span of 30 years, the fixed monthly payment totals at $507. In this value, during the first month, we will see that $375 goes to cover the interest, and the remaining $132 covers the principle. Towards the mortgage’s mid-term, there is a switch with $249 going to the interest and $257 to the principle. The last mortgage payment will be split into $2 for the interest and $505 for the principal.

How does Mortgage Amortization work?

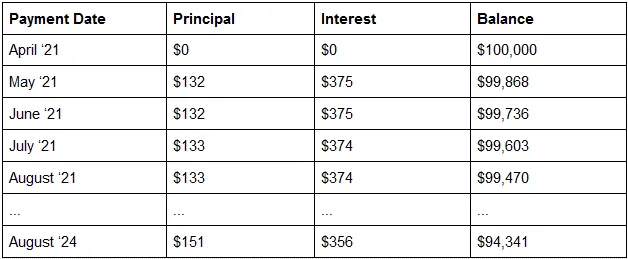

Mortgage amortization is a repayment plan that uses an amortization table or amortization schedule as a way to visualize the concept. An amortization schedule is a grid or table showing how payments are split between the interest and the principal, and the balance that remains after each payment. Below you can see how mortgage amortization works in time.

With mortgage amortization, after four payments, the balance reaches $99,470, and in 3 years, the balance is $94,341. An amortized mortgage is a loan where the balance decreases gradually at first and more abruptly in the final years. Similarly, equity is built slowly at first but more rapidly in the last years.

Popular Real Estate Terms

Property deed in which the grantor limits the title warranty to the grantee. A grantor does not warrant a title defect to the property occurring from a happening before the time of his ...

The substitution of one person or business for another when the substituted person or business has the same rights and obligations as the original party. An insurance company can surogate ...

Home inspector is the name the real estate industry calls the professional responsible for the close and thorough examination of a property. The home inspector usually is called upon ...

Way to determine the capitalization rate of income property for valuation purposes by weighting the rate of interest and source of financing in percentage terms. ...

Sudden, drastic change in organization, direction, objectives, strategies, or functioning. It is often associated with a new owner who wants things his way. Managers and employees may ...

Also called an installment sales contract or contract foe feed. A type of creative financing in real estate allowing the seller to finance a buyer by allowing him or her to make a down ...

Method of revenue recognition based on delivery instead of sale. ...

Broadly speaking, a commission is a remuneration a person receives after acting on someone else’s behalf.In the real estate world, you’ll usually hear the term “sales ...

(1) Return of the principal invested in real estate. It excludes income earned. (2) Collection of a previously written off bad debt. ...

Have a question or comment?

We're here to help.