Mortgage Amortization

The term mortgage amortization is the steady switch occurring to each mortgage payment between how much interest is covered and how much principal each month. Simply put, mortgage amortization is the plan for repaying a mortgage. Because the debt diminishes with each payment, the interest diminishes, and because the interest decreases monthly, the principal coverage increases with each payment.

The Mortgage Amortization Definition

Amortization is the way through which mortgages are repaid. This feature can be applied to mortgages with an equal monthly payment and a fixed timeline. Mortgages, as well as other loans, can be amortized.

Let’s see this through a more practical explanation. The trademark of an amortized mortgage or amortized loan is the shift from paying mostly interest every month to mainly paying principal every month. The math goes like this: for a $100,000 mortgage with a 4.5% interest rate, amortized over a span of 30 years, the fixed monthly payment totals at $507. In this value, during the first month, we will see that $375 goes to cover the interest, and the remaining $132 covers the principle. Towards the mortgage’s mid-term, there is a switch with $249 going to the interest and $257 to the principle. The last mortgage payment will be split into $2 for the interest and $505 for the principal.

How does Mortgage Amortization work?

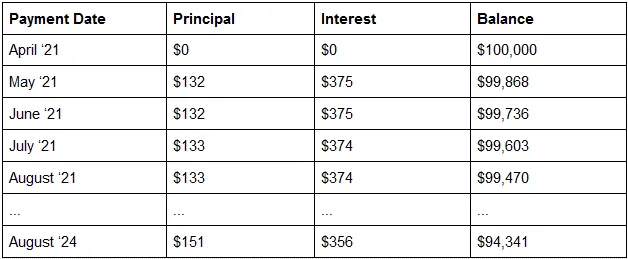

Mortgage amortization is a repayment plan that uses an amortization table or amortization schedule as a way to visualize the concept. An amortization schedule is a grid or table showing how payments are split between the interest and the principal, and the balance that remains after each payment. Below you can see how mortgage amortization works in time.

With mortgage amortization, after four payments, the balance reaches $99,470, and in 3 years, the balance is $94,341. An amortized mortgage is a loan where the balance decreases gradually at first and more abruptly in the final years. Similarly, equity is built slowly at first but more rapidly in the last years.

Popular Real Estate Terms

Right to property depends on some occurrence. ...

Easement with the objective of keeping scenic beauty or to forbid constructing something else blocking that view. The property is retained in its natural setting. ...

Correcting depreciation by making improvements at less cost than the value added. For example, the management of an aging strip shopping center makes a decision to refurbish the windows and ...

Representative house, apartment, or cooperative used as a sales tool to show how the actual unit bought will probably appear in design and construction. An example is a model apartment. ...

Property owned and held jointly and equally shared by each spouse. It is purchased during their marriage, regardless of the wage-earning situation of either spouse. A spouse may not make a ...

When you sign a Listing Agreement with a real estate broker or agent, he or she has a fiduciary responsibility to represent your interests exclusively. However, should another client ...

Two or more people have a legal duty that can be enforced against them by joint action, against all members, and against themselves as individuals. For example, a bank can require repayment ...

Property highly leveraged. An example is when a landlord buys an apartment house paying minimum cash payment down and the balance on mortgage. ...

Early American style 1 story house with a steep gable roof covered with shingles. The bedrooms are on the first floor, but the attic is often finished and made into additional bedrooms. ...

Have a question or comment?

We're here to help.