You may not have heard the word “escrow” before you stepped into the world of home buying, but you’ve heard it now. “Escrow” is part of what makes buying and selling homes a little more organized and provides some measure of security for both sides in case the sale falls through.

The home buying process doesn’t only involve the buyer and the seller. While that might be the case in some situations, in most of them, it isn’t. As we explain the escrow process, most real estate transactions involve an escrow provider who will be a valuable asset for the transaction. This trusted third party holds documents and funds from and for both the seller and the buyer.

The escrow process provides a third-party intermediary designated to safeguard funds and documents required for the real estate transaction. The escrow holds these assets under the terms and instructions of the other two parties until the purchase terms are met. When the contract and mortgage agreement terms are met, the funds and/or documents are released from escrow, and the transaction can carry on as previously established.

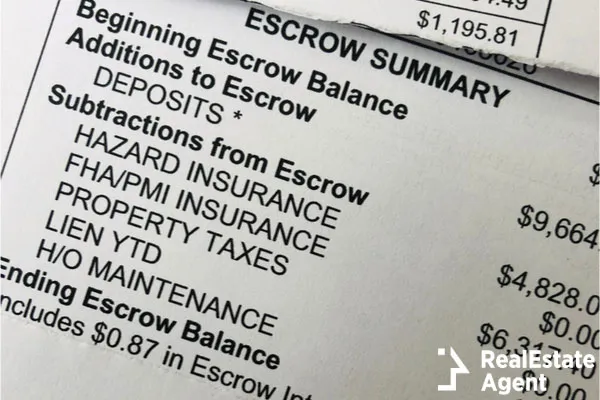

An escrow can also be used after the real estate transaction is completed. In that situation, the escrow account is used to ensure that part of the mortgage payment is reserved for tax and insurance payments.

In the following sections, we’ll look into all the details related to an escrow, how it works, who’s responsible for it, and what it is used for. The two main applications for escrows are to secure a home purchase and to secure tax and insurance payments. So, buckle up!

What is an Escrow?

When the time comes to sign your home’s purchase contract, you might also need to make an earnest money deposit in an escrow account. This amount of money comes from the downpayment and ensures the seller that you, as a buyer, won’t back out of the sale.

Through an escrow, both parties are protected as the party responsible for the escrow is an independent and trusted third party. An escrow occurs when one party deposits money intended for a second party for safekeeping with the third party until certain conditions are met. The seller accepted the offer and took the home off the market. The contract was signed, but inspections highlighted some issues with the property that were not mentioned in the agreement. This point already sets up the escrow, and if the buyer backs out, they lose the earnest money they deposited in the escrow. If the seller backs out, they also lose the money, losing the sale. However, if the buyer and seller agree to meet the contract terms to finalize the sale, the earnest money deposit and documents are held in escrow until those terms are met.

For example, Bob has offered to buy George’s house in San Francisco. However, they need to hammer out some details because George’s house needs a new roof before Bob meets his asking price. George is willing to replace the roof, but only if he knows Bob is earnest about making the offer.

How does Escrow Work?

There are a variety of third parties that can be responsible for an escrow account. Some of these are escrow companies, mortgage servicers, or escrow agents.

Following the little story from above, Bob is the buyer, and George is the seller. Tom can be one of several things - an escrow officer from an escrow company, someone from a title company, an official from a title & escrow company, or a title & escrow attorney. However, the stage of the real estate process determines who will manage the escrow account.

Escrow Agents and Companies

An escrow can be managed by an agent or a mortgage servicing company during the home buying process. Sometimes, the individual responsible for the escrow is an escrow agent or an escrow company which can be the same as a title company.

We specified that an escrow doesn’t only involve funds because deeds and other documents are often held in escrow as well. These all are managed by the same escrow entity. Both seller and buyer use the same escrow company or agent in the real estate transaction. Because of this, the escrow fee is split evenly between the two parties.

Mortgage Servicers

From the closing date until you pay off your mortgage loan, your mortgage servicer manages your mortgage. This individual is in charge of bringing in your mortgage payments, keeping a record of these payments, and managing your escrow account.

The mortgage servicer isn’t required to be your lender, as some lenders outsource these loan servicing rights to third parties. Those lenders that service their own loans usually charge less for these services but can also charge more. It’s always best to know ahead of time and see which option is better for you.

When a mortgage servicer manages your escrow account, there is little to no fuss from your end. They have your tax information and insurance bill data available. They know what money needs to go where and when. You only need to provide them with additional information if you change your insurance policy or provider.

When is Escrow Required?

Escrow is commonly required from the potential buyer in most home sales. They are also often used to ensure monthly payments are met once the real estate transaction is completed. It is written into the contract drawn up, with stipulations detailing the expectations and conditions for escrow to be released. These are called contingencies.

As each contingency is met, the buyer and seller sign off on it. After all, contingencies have been signed off on, the loan amount is funded, and closing accomplished. Escrow is released, and a new deed is recorded for the property under the buyer's name. The loan funds are disbursed, the seller is paid for the home, real estate agents and other parties involved are paid their fees, and the sale is final. This is what is called a short-term escrow account.

After the closing is finalized, however, your lender will open a second escrow account that will cover the length of your loan. Lenders often require this second escrow agreement to ensure that you don’t miss out on property taxes and homeowners insurance payments.

Purchase Escrow

When Bob makes an offer to buy George’s house, and George accepts that offer, usually, the earnest money is deposited into an escrow account. The earnest money deposited works to guarantee that your intentions of buying the property are serious.

When the real estate deal is completed and both parties sign all the necessary documents, the escrow account manager releases the earnest money. It is common for buyers to get their earnest money deposit back and add it to their down payment and closing costs.

If the sale falls through because Bob backs out, he’s unlikely to receive their earnest money deposit back. However, if inspections find some major issues with the property, the buyer can back out of the sale and receive their deposit back. Still, if the problems are fixed, and the sale goes through, the escrow agreement did what it was designed to do - work as a security between the buyer and seller until the contractual obligations are fulfilled. Both parties are satisfied with the transaction.

Mortgage Escrow

Once the real estate property is bought and the transaction is completed, the mortgage lender may require the buyer to start a second escrow. Unlike the purchase escrow account, this is not between the seller and the buyer. While the lender is the escrow agent, the buyer is one party of the escrow agreement, and the other party is the government and the insurance company.

In this case, the escrow works as security installed by the lender to make sure the borrower pays their homeowners insurance fees and property taxes. From the monthly mortgage payment, the escrow agent sets aside what is determined necessary to maintain the mortgage to cover insurance fees and taxes for the property they lent the money for. They deposit this amount into the escrow account. Like this, the escrow agent ensures that these taxes are paid when the property taxes and homeowners insurance are due. Like this, the homeowner will not be late with payments, and neither the insurance company nor the government can place a lien against their house.

How Much is Escrow?

Custom and local market conditions will factor into how much earnest money is asked to be placed in escrow. The type of escrow you have can also differentiate the escrow payment.

The purchasing escrow, the short-term type, is a one-time fee that requires an escrow fee for the escrow agent that is split between the buyer and seller. The amount typically totals about 1 to 2 percent of the cost of the home. If Bob and George agree on $400,000, Bob will have to deposit somewhere between $4,000 and $8,000 in an escrow account.

The mortgage escrow is a long-term agreement that requires a monthly fee from the homebuyer. The escrow agent takes the insurance costs and property taxes into account to determine the escrow costs. Firstly, when the real estate deal is completed, the lender can require the homebuyer to pay the first year of homeowners insurance upfront. Then the homebuyer will start funding for the following year’s coverage through their monthly mortgage payments. Secondly, to cover the property taxes, the lender must determine when the property taxes are due. Some lenders require three monthly property tax payments upfront to set up the escrow account.

For example, with annual property taxes of $4,800, the lender can require $1,200 upfront to start and fund an escrow for those taxes. If we take $4,800, divide it by 12 (months) and add that number to 3 (months), we get $1,200.

Conclusion

An escrow is an essential and necessary element of the home purchase process. On the one hand, it works as a safety net for both the buyer and seller during the real estate transaction. It does this simply because buyers are less likely to walk away from a sale if they have already invested money in it. On the other hand, homeowners can rest assured that their property taxes and homeowners insurance fees are covered through their monthly mortgage payments. As long as they manage to meet those payments, they can rest assured that their home-related financial obligations are fulfilled.

An escrow isn’t always required, and it can depend on the type of loan chosen by the home buyer, but at the same time, their financial profile can make a difference. Some consider that an escrow entails a higher monthly mortgage payment, and they are right as that monthly mortgage payment will also cover taxes and insurance costs. However, the service provided for the homeowner by taking care of that responsibility for them in making sure those bills get paid can go a long way.

Let us know in the comments below if you have any other questions about escrows and how they work. Like & Share this article with friends and family that are planning to go into a real estate transaction in the near future.

Have a question or comment?

We're here to help.